Financial reporting can be defined as the method that help to record all the financial information in different types of statements so that organisation's performance can be examined. For all the organisations it is very important to formulate final accounts like income statement, balance sheet and cash flow statement for the purpose of analysing financial strength of a company. In this project report an accountant of a leading accountancy firm is going to conduct financial reporting for Marks and Spencer which is a multinational retailer in Britain.

This assignment is providing different types of services such as banking (Adetula and Owolabi, 2014). This assignment contain detailed information about financial reporting its purpose, conceptual and regulatory frameworks and their requirements, principles and purpose, benefits of financial information to the key stakeholders, role of financial reporting in meeting organisational goals and objectives, generation of financial statement so that organisation's financial performance can be communicated and interpreted etc. Benefits of IFRS and its differentiation with IAS and varying degree of compliance with IFRS have also been discussed under this report.

Main Body

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

1. Financial reporting and its purpose

Financial reporting:Â

It is the way in which organisations formulate their financial statements that are presented in front of external stakeholders for the purpose of providing them information of organisational performance. In Marks and Spencer it is conducted by the accountants so that competitiveness of the organisation can be examined. All the finance related information is provided to the external parties to enhance their interest in the company. If the managers of the company are catering transparent data to the stakeholders than it can help to attain organisational goals.

Marks and Spencer is successfully running its business all around the world hence it is very important for the company to formulate financial statements in appropriate manner so that business can be operates more effectively (Beneish, Miller and Yohn, 2012).

There are three different types of financial statements are formulated by the accountants of Marks and Spencer these statements are cash flow, balance sheet and income statement. All of them help the internal as well as external stakeholders to analyse organisation's financial health so that they may take appropriate decisions. All the companies conduct financial reporting for various purposes, some of them have been discussed underneath:

Purpose of financial reporting:

- Financial reporting is concerned with the appropriate formulation of financial statements so that a transparent and positive image of the organisation can be presented in front of internal as well as external stakeholders.

- It is conducted to render result of organisation's operations and different executional activities that are performed by the company in order to maximise sales and profits for the future (Dhaliwal and et.al., 2012).

2. Regulatory and conceptual framework and their requirement, purpose and key principles

Regulatory and conceptual framework:Â

Government of every nation implement various rules, principles and regulations that are related to the effective formulation of financial statements for all the organisation. This done for the purpose of executing business successfully. All the imposed regulations are the frameworks that are essential for all the organisations to follow as they are required for the effective representation of organisational position. Marks and Spencer is implementing all the regulatory and conceptual frameworks that are imposed by legal authorities because it is beneficial for the company and also help to establish a positive image in the mind of stakeholders. IASB is the regulatory authority who incorporates different types of financial reporting standards so that all the business entities can record all the information in final accounts properly (dos Santos, Fávero and Distadio, 2016).

Marks and Spencer is using all the standards in its financial reports as they are required for all the companies who are operating business on international level. IFRS are the set of standards that are imposed by IASB, that are described below:

IFRS (international Financial Reporting Standards):

These are introduced by IASB (International Accounting Standards Board) that guides the organisations to formulate financial statements in appropriate manner. Some of the main IFRS are as follows:

- IFRS 1: It is induced for the organisations who are going to adopt IFRS for the first time. It guides them through out the way of recording so that financial statements can be formulated properly.

- IFRS 10: All the organisations with various subsidiaries are directed to formulate all their financial statements in consolidated form. According to IFRS 10 the parent company is responsible to conducted financial reporting and generate final accounts on behalf of all its subsidiary companies.

Marks and Spencer is following all the standards under IFRS because it may help to keep accurate financial information of the organisation.

Purpose of conceptual and regulatory framework:

- Conceptual and regulatory frameworks are introduced for the purpose of facilitating the organisation in the process of financial reporting.

- Main purpose of both the frameworks is to determine performance of whole organisations and provide it to the stakeholders to formulate strategic decisions.

Qualitative features of financial information:

Faithful representation:Â

This quality of financial information can help to increase trust of stakeholders because if the information is faithful than they can analyse actual performance of the company. It will help to make the information more reliable because of its transparent nature (Qualitative Characteristics of Financial Information, 2013).

Appropriateness:Â

If the recorded data is appropriate than it will increase relevancy of the information and help to determine organisational performance and its financial status of the organisation.

For Marks and Spencer it is very important to add both the characteristics in the financial statements to increase reliability of the information. It will help to enhance interest of investors and shareholders of investing funds in the company.

3. Key stakeholders of the company and benefits of financial information to them

Stakeholders of an organisation are the persons who are responsible for the success. It is very important to provide them benefits so that their interest can be raised for the betterment of the company. There are two different types of stakeholders in Marks and Spencer and for the business entity it is very important to provide them appropriate financial information. Both the stakeholders are as follows:

Internal stakeholders:Â

These are the persons who are responsible to make strategies for the company in order to operate business effectively. In Marks and Spencer internal stakeholders are shareholders and managers (Hadi, Suryanto and Hussain, 2016).

- Shareholders:The individuals who have invested their money in the company try to evaluate organisational performance with the help of financial information. They can analyse that their finance is utilised appropriately or not.

- Managers:They measure financial information of the company because it helps them to formulate strategies according to current status of Marks and Spencer in the market.

External stakeholders:Â

The outsider parties of an organisation who are responsibility for the effective execution of the business called external stakeholders. Customers, investors, creditors are the external stakeholders of Marks and Spencer:

- Customers:Financial information is very beneficial for the customers of Marks and Spencer because it may help them to make buying decisions by analysing organisation's performance and financial strength.

- Investors:The individuals who invest their money in the company for the purpose of attaining higher returns on their investment. Financial information which is gathered from balance sheet is very beneficial for the company because this may help to determine possible returns that can be acquired by them in future (Isenmila and Adeyemo, 2013).

- Creditors:The external parties who provide material to marks and Spencer on credit are the creditors. Financial information collected from income statement and balance sheet is very beneficial for them because this may help them to analyse organisation's credit strength to make decision related to providing credit or not.

4. Value of financial reporting in meeting goals and objectives of the company

Financial reporting is very beneficial for all the organisations to attain goals and objectives. As the goal of Marks and Spencer is to be the first choice of customers by retaining and satisfying them. This can be achieved  with the help of financial reporting because it can help them to determine organisation's financial strength and market position. If the market image is very good and organisation is financially strong then it can help to retain existing customers by gaining their trust with the help good position and performance.

Main objectives of Marks and Spencer is to maximise profits and attract investors. Appropriate and transparent financial statements can help to attain both the objectives because investors always invest in such organisations who can provide them higher returns on their money. They can evaluate financial status of Marks and Spencer and than can make decision to invest or not to invest in the organisation. If performance and position of the company can is very good and the financial statemented are showing the same than it can help to attract large number of investors.

Objective of profit maximisation can be achieved by increasing sales which is possible by satisfying customers. If Marks and Spencer is providing actual financial information to its customers than it can help to achieve the objective of profit maximisation (Louwers and et.al., 2015).

5. Formulation of financial statements of the organisation

- Statement of profit and loss and statement of comprehensive income:

|

Particular

|

Amount

|

|

Revenues

|

385100

|

|

Less: Cost of sales

|

-297563

|

|

Profit

|

87537

|

|

Add: Other income

|

5600

|

|

Gross profit

|

93137

|

|

Less: operating expenses

|

-83663

|

|

Operating profit

|

9475

|

|

Less: Finance cost

|

-830

|

|

Profit before tax

|

8645

|

|

Less: Tax

|

-1500

|

|

Profit after tax

|

7145

|

|

Add: Other comprehensive income

|

2100

|

|

Total Comprehensive income

|

9245

|

From the above statement it has been observed that profits of the company for the year are 87537 and operating profits are 9475. Total profit before tax is 8645 and the tax for the period is 1500. Profit after tax is 7145 and total comprehensive income is 9245.

- Statement of changes in equity:

|

Particular

|

Ordinary share capital

|

Revaluation reserve

|

Retained earnings

|

Total

|

|

As per trial balance

|

86700

|

40700

|

32100

|

159500

|

|

Total Comprehensive income

|

Â

|

2100

|

7145

|

9245

|

|

Preference dividend

|

Â

|

Â

|

-2330

|

-2330

|

|

Ordinary dividend

|

Â

|

Â

|

-4340

|

-4340

|

|

Â

|

86700

|

42800

|

32575

|

162075

|

From the above calculation it has been analysed that ordinary share capital of the company is 86700, revaluation reserve is 42800 and retained earnings are 32575.

- Statement of financial position:

|

Assets

|

Amount

|

|

Non current assets:

|

Â

|

|

Land and property

|

115000

|

|

Plant and equipment

|

37275

|

|

Investment property

|

25400

|

|

Total non current assets

|

177675

|

|

Current assets:

|

Â

|

|

Inventory

|

17300

|

|

Trade inventories

|

62000

|

|

Total current assets

|

85300

|

|

Total assets

|

262975

|

|

Â

|

Â

|

|

Equities and liabilities

|

Â

|

|

Ordinary Share @25 each

|

86700

|

|

Revaluation reserve

|

42800

|

|

Retained earning

|

32575

|

|

Total equities

|

162075

|

|

Non current liabilities:

|

Â

|

|

10% redeemable preference share

|

23300

|

|

Deferred taxation

|

8900

|

|

Total non current liabilities

|

32200

|

|

Trade payables

|

65700

|

|

Bank overdraft

|

1500

|

|

Tax payables

|

1500

|

|

Total current liabilities

|

68700

|

|

Total equities and liabilities

|

262975

|

Statement of financial position of the company depict organisation's financial position and it financial strength. According to abode statement total non current assets of the company are 177675 and total current assets are 85300. total equities if the organisation are 162075, total non current liabilities are 32200 and total current liabilities are 68700.

- Difference between information which is provided by cash flow and financial statements:

The information which is provided by cash flow statement and financial statements are totally different from each other because cash flow only provide information related to cash inflow and out flow but financial statements provide different types of information like revenue, purchase, incomes, expenses, assets, liabilities etc. All of them are used by external stakeholders to analyse organisation performance and information of cash flow is used by managers and owners to analyse liquid strength of the company (Morrow, 2013).

6. The way in which financial statements are used to communicate and interpret financial performance

As analysed form the financial statements of Marks and Spencer from Appendix that total revenues of the organisation were 10622000 in year 2017 and it has been increased up to 10638200 in year 2018. Cost of revenues for year 2017 and 2018 are 6629300 and 6745600 respectively. Profits of marks and Spencer in year 2018 have decreased up to 3952600 from 3992700 which is related to year 2017. Earning before interest and tax of Marks and Spencer has been decreased in year 2018 as compare to 2017. EBIT for both the years are 707300 and 677400 respectively.

Net income of the organisation is 117100 and 25700 for both the years 2017 and 2018. Total current assets for year 2017 are 1723300 and for 2018 it is 1317900 which has been decreased in year 2018. Total assets of Marks and Spencer are 8292500 and 7550200 for year 2017 and 2018 respectively. Shareholder's equity of Marks and Spencer has been reduced in year 2018 up to 2956700 from 3156300 which is related to 2017. Total liabilities of the company were 5142100 in year 2017 and these are decreased in year 2018 and reached to 4896000.

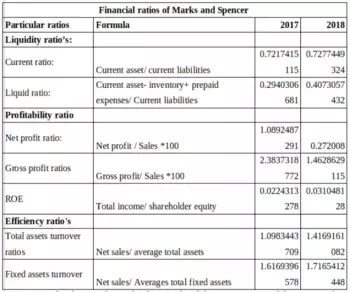

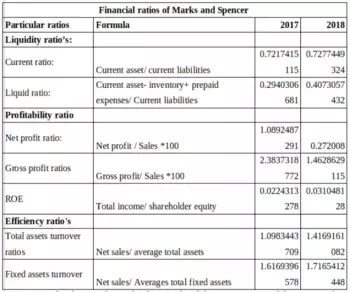

Financial ratios of the company:

From the above ratios it has been analysed that current ratio of Marks and Spencer has been increased in year 2018 as compare to 2017. fro both the years ratios are as 0.721 and 0.727 respectively. Liquid ratio of the company ash also been increased in 2018 up to 0.407 from 0.294 which is for 2017. Net profits ratio of the company has been reduced in year 2018 up to 0.272 from 1.089. Gross profit ratio for both the years are 2.383 and 1.462. ROE for 2017 is 1.022 and for 2018 it is 0.031. Total assets turnover ratio for year 2017 is 1.098 and for 2018 it is 1.416. Fixed assets turnover ratio for both the years are 1.616 and 1.716 respectively.

Financial statements and their information help the stakeholders to evaluate and analyse organisational performance. It guides them to make appropriate decisions so that they may get long term benefits. If the company is not providing appropriate financial information to its stakeholders than it may result in decreased interest on them in the organisation.

Financial governance:

7. Differences between IFRS and IAS

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

IFRS (International Financial Reporting Standards):

All such type of standards that are related to internal financial reporting have been launched by IASB who is responsible for the same. Main purpose of IASB for the introduction of these standards is to provide a common global language to the organisations so that they can attract foreign investment (Mullinova and Simonyants, 2016). All these standards are followed by marks and Spencer as it is executing business all around the world. It guides the accountants to maintain all the financial information in appropriate manner so that financial statements can depict actual positions and financial strength of the company.

IAS (International Accounting Standards):

These are the set of standards that are introduced by IASC (International Accounting Standards Committee) to facilitate all the companies while recording transactions in the books. These were the older standards that are replaced by IFRS in year 2001.

Difference between IAS and IFRS:

|

IAS

|

IFRS

|

|

IAS stands for International Accounting Standards.

|

IFRS are the International Financial Reporting Standards.

|

|

International Accounting Standards Committee have launched all the IAS.

|

International Accounting Standards Board have introduced all the standards under IFRS.

|

|

IAS were published in year 1973 to facilitate organisation in the reporting procedure.

|

IFRS were published in year 2001 to resolve all the issues resulting from IAS.

|

|

While recording transactions in the books of accounting than IAS are followed.

|

If any contradiction arise due to IAS than IFRS should be followed by the organisation.

|

8. Various benefits of IFRS

IFRS has consist of accounting rules and regulations which describe that how transactions can be recorded and what information and data should be disclosed in financial statements (Page, 2014). There are various benefits of using IFRS, which are as:

- It provides help in greater comparability because organisations that use same accounting standards to prepare its financial statements can be compared with each other more accurately. It is useful in that case when an organisation has operates its business in two different nations.

- It is more flexible because it is based on principles based standards rather than rules based standards. IFRS help to reduce the  manipulations in accounts as a result more accurate financial statements can be prepare.

- It maximize the flow of capital because it facilitates the convergence and transparency in accounting practices.

IFRS is very beneficial for Marks and Spencer because it can help to record all the financial information appropriately and attract foreign investors so that funds can be raised for the operations.

9. Varying degree of compliance with IFRS

For all the organisations it is very important to follow standards that are imposed by IFRS because it can help to operate business effectively. If the organisations are not able to implement the standards appropriately than it may result negatively. As Marks and Spencer is operating business in various countries hence it is not possible for the organisation to follow rules and regulations of all the countries. IFRS is the right option for the organisation because this may help to operate the business appropriately and effectively (Papadamou and Tzivinikos, 2013).

For example, Marks and Spencer can use international accounting standards so that all the reporting related problems can be resolved. It is very important fro the accountants of Marks and Spencer to follow all the principles so that all the information can be recorded appropriately.

Conclusion

From the above project report it has been concluded that financial reporting is the process of generating financial statements that help the external parties of an organisation to analyse financial strength of the company. IASB is the regulatory authority of financial reporting and various standards are imposed that are called IFRS. For all the companies it is very important to follow all the principles of IFRS so that actual and transparent information can be rendered to the stakeholders like customers, investors and shareholders to make buying and investing decisions. All the internal and external stakeholders evaluate strength of the company with the help of financial statements.

References

- Adetula, D. T. and Owolabi, F., 2014. International financial reporting standards (IFRS) for SMEs adoption process in Nigeria. European Journal of Accounting Auditing and Finance Research. 2(4). pp.33-38.

- Beneish, M. D., Miller, B. P. and Yohn, T. L., 2012. The impact of financial reporting on equity versus debt markets: Macroeconomic evidence from mandatory IFRS adoption.

- Dhaliwal, D. S. and et.al., 2012. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. The Accounting Review. 87(3). pp.723-759.

- dos Santos, M. A., Fávero, L. P. L. and Distadio, L. F., 2016. Adoption of the International Financial Reporting Standards (IFRS) on companies’ financing structure in emerging economies. Finance Research Letters. 16. pp.179-189.

- Hadi, A. R. A., Suryanto, T. and Hussain, M. A., 2016. Corporate Governance Mechanism on the Practice of International Financial Reporting Standards (IFRS) among Muslim Entrepreneurs in Textile Industry-The Case of Malaysia. International Journal of Economic Perspectives. 10(2).

You may also like to read : APC311 International Financial Rporting

Amazing Discount

UPTO50% OFF

Subscribe now for More

Exciting Offers + Freebies

Super-fast Services

Super-fast Services