Managing executives needs appropriate business data to make successful decisions. It is a challenging task to gather data for this intent via various organizational processes. Most businesses enforce accounting management to conduct such a complicated task as to enable businesses to grow an efficient framework. Management accounting is almost always seen as managerial accounting and it can be viewed as an efficacious structure that provides the executives of inside the organization with financial information for quick decision-making. It is primarily viewed by executives as an internal mechanism that seeks to maximize overall fiscal and functional efficiency (Chandar, Collier and Miranti, 2012).

This report demonstrates multiple MA systems and crucial reports in context of Sam Weller Limited, UK's leading manufacturer of decatising wrapper manufacturers in the world. Company is working with cloth finishing sector, offering an wide range of services and products though manufacturing and use of decatising wrappers. In addition, the report explores various preparation methods and their use in organizational layout and analysis about how these aid to tackle financial issues. In addition, this study consists of a detailed company comparison regarding the formulation of systems to overcome distinct financial challenges.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Main Body

Task 1

Managerial accounting includes the use of specific skills and expertise in preparing financial details to assist business in the development of strategies as well as the managing and control of business processes. It offers the methods and procedures needed to select among alternative organization practices, conducts and evaluation via performance assessment and evaluation of effective planning. At regular periods, say monthly, quarterly, executives are provided with fiscal data and non-financial information. This information includes a thorough evaluation, forecasts and budgets. Thus, it allows managers to plan company activities. It also requires several graphical graphs, estimates and analytical thinking which can be incorporated throughout the decision-making process through controlling staff (Fiondella, Macchioni, Maffei and Spanò, 2016).

Management Accounting Systems:

MA contains some specific systems which help companies like Sam Weller Limited in effective adaption of overall management accounting framework. Each system of MA contains several significance which are utilised by managers in effective managerial decision-making procedures. Following is a comprehensive discussion upon different systems of MA, as follows:

Cost-Accounting System:

This is an accounting system sort that is attributed to the procedure of a coordinated cost prediction. It is attributed to financial department of the corporation in order to allow them to establish effective controls over costs and expenses. Fundamentally, the main goal of this accounting system is to define such activities that result in higher business costs. In fact, it is critically vital for companies to reduce total spending appropriately. These systems are incorporated in Sam Weller Limited to minimize the burden of manufactured products with the aim of increasing the general profit margin for each unit manufactured by the corporation. Because it embraces production executives to assign determinants that are the main trigger of rising costs and regulating these variables result in decreased production costs.

Price optimisation system:

This is another vital system which clearly exhibits liaison or core relationship among demand and value/price determined for any product within an organisation. Â Â Â Â Â It is significant aspect of cost and financial structure of company as to fix most relevant and cost effective price for products where demand for product is maximum. Company Sam Weller Ltd is also framed and implemented this system to analyse existing prices of its products and set most appropriate with aims to achieve maximised demand and sales (Granlund and Lukka, 2017).

Inventory management system:

This provide a framework for effective management of stock and inventories items. This can be characterized as a style of management system associated with the coordinated system that focuses on those procedures in a company related to the entry and distribution of inventories. Usually a significant range of stocks / inventories are obtained and manufactured along with several other factors in a supplier or distributor business for the selling of goods. It allow inventory managers to establish routine check on different inventories items. Corporations which are engaged in manufacturing operations like  Company Sam Weller Ltd, have large volume and distinct-distinct inventories items due to which managing and controlling of such a large range of items is challenging scenario. Management in respective corporation utilise this system to develop a organised structure for  establishing proper control overall numerous stock items. This system also enables enterprise to value its distinguish stock items through different approaches like First-in first-out, Last-in last-out and average-cost method. Here below is explanation about such approaches, as follows:

Average cost method:Â

Average cost approach attributes a price to inventory-item based on overall cost of bought or manufactured/processes items over a duration divided by aggregate amount of bought or processed products.

Last-in last-out:

this approach is applied for inventory under which records least-recently manufacture items are regarded as sold first. This is most widely accepted method of valuing inventories.    Â

FIFO method:Â

This approach value inventories of business by considering that very-first manufactured or processed item in inventories are sold first (Hirsch, Seubert and Sohn, 2015).

Job order costing system:

This is a distinguishable and exceptional system where different business activities are recognized as work and collated expenses are allocated to such specific jobs. This method is interesting as it describes various manufacturing process employment and increases productivity improvements by operating cost allocation. In Sam Weller Ltd, managing officials utilise this system to determine the cost of different job processes and optimise them while defining different job roles. Â Â Â Â

Management Accounting Reports:Â

Managerial accounting reports could provide corporations with the data they really want to reduce costs, recompense well-performing workers, cut floundering products, and spend in products which provide enterprise with finest financial return. Based on the nature of activities performed by the company and the time-sensitivity of fiscal reports provided by the company, management in company may demand or produce reports annually, quarterly, daily or monthly basis. As in company Sam Weller Ltd, management using different reports of MA which assist company in performing different operations, as follows:

Inventory Management Reports:

These sort of reports provides detailed and systematic record of inventories like raw material, work-in progress, finished products, processes goods, spare tools and other stock items. This is a classified report which segregates each inventory item as per their nature and significances. Specially in manufacturing and production firms like Sam Weller Ltd, this kind of reports are used for effective and real-time tracking of their wider amount and volume of stock items. It help to evaluate factors which are resulting in increasing inventory costs. Company can effectively manage and monitor inventories to achieve operating effectiveness.   Â

Performance Reports:Â

This report allow owners and managing personnel to keep a proper record of performance in all aspects of all employees. This report involves arranged and classified data of performance of employees belongs to different divisions. Further reported data of performance report enables top managers to assign different duties, responsibilities and roles as per employees' capacities, competences, skills and previous performance in corporation. It entails a comprehensive assessment of employee performance that is utilised by manager to apportion duties to employees as well as work according to quality and abilities in results (Hoque, Covaleski and Gooneratne, 2013). The fundamental objective of such a report is to strengthen distinct employees' organisational capacities. Decisions also drawn on the basis of the results of this report enable companies to regulate the turnover of employees in Sam Weller Ltd.

Operating budget report:Â

This report demonstrates the overall operational performance of company. An operating budget report comprises of all profits and expenditures that a company or agency uses to schedule its activities over a duration of time (typically one quarter or one year). In preparation of an accounting period, operating budget-report is defined as a target or objective to be achieved by the company. In  Sam Weller Ltd this report is prepared by managers to asses the actual operating performance of company as in comparison with stated budgeted figures in report. It allow company to effectively evaluate the operating effectiveness of different manufacturing and production processes.    Â

Benefit of MAS :

|

Name of MAS

|

Advantages/benefits

|

|

Cost accounting system

|

Major advantageous thing of this system is that it provide a managed framework to minimise numerous costs and eventually lead to enhancement in operational capacity in  Sam Weller Ltd.

|

|

Price optimisation system

|

This system develops a assistive framework for taking quick derisions regarding determination of prices of different items with object to retain or increase demands. Â Â

|

|

Job Costing System

|

It advantageous for companies to define role of different jobs and assess the real cost of each job process within organisation.

|

|

Inventory management system

|

It facilitates corporation with effective valuation of different inventories items and identify causes of increased abnormal loss and theft of inventories (Horton and de Araujo Wanderley, 2018).

|

Integration of MAS and reports to organisational process:

All systems are strongly connected to different business structures in delivering data to and from these discussed systems. The managers also attempt to incorporate MA reporting and systems into business procedures for efficient system execution and reporting. Since accounting procedures include vital data used in programs such as expense accounting and stock control, and this division produces knowledge that is utilised by accountants to file financial reports.

Task 2

Assessment of costs utilising core techniques of costs-analysis with aim to frame income statement though absorptions and marginal costs:

Marginal Costing:

This is most relevant approach of costing under which variables costs are charged to each unit produced. Here marginal cost involve only those costs which changes simultaneously with change in production volume.  Â

Absorption Costing:Â

Under it all productions and manufacturing including fixed and variables are classified as cost of sales to assess gross profit. It is simple approach where are all the production costs are assigned to produced unit (Kastberg and Siverbo, 2016).

Income statement under absorption and marginal costing:

Absorption costing:

|

Absorption Costing Statement calculator

|

|

Â

|

Â

|

|

Unit Selling Price

|

8

|

|

Unit Cost (FC+VC)

|

5

|

|

Fixed Manufacturing Expenses

|

150

|

|

Non Manufacturing Exp

|

50

|

|

Budgeted Activity

|

75

|

|

Period

|

04/19

|

05/19

|

06/19

|

07/19

|

08/19

|

01/09/19

|

|

Â

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

|

Sales

|

75

|

60

|

90

|

75

|

70

|

80

|

|

Production

|

75

|

75

|

75

|

75

|

85

|

70

|

|

Opening inventory                                                                                   Closing inventory

|

0

|

0

|

15

|

0

|

0

|

15

|

|

Â

|

0

|

15

|

0

|

0

|

15

|

5

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Period

|

04/19

|

05/19

|

06/19

|

07/19

|

08/19

|

09/19

|

|

Â

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

|

Sales

|

600

|

480

|

720

|

600

|

560

|

640

|

|

Opening inventory

|

0

|

0

|

75

|

0

|

0

|

75

|

|

Add: Variable Cost[Production]

|

375

|

375

|

375

|

375

|

425

|

350

|

|

Less: Closing Inventory

|

0

|

75

|

0

|

0

|

75

|

25

|

|

Marginal Cost of Sales

|

375

|

300

|

450

|

375

|

350

|

400

|

|

Gross Profit

|

225

|

180

|

270

|

225

|

210

|

240

|

|

Adjustment for Overheads

|

0

|

0

|

0

|

0

|

-20

|

10

|

|

Less:Non Manufacturing Cost

|

50

|

50

|

50

|

50

|

50

|

50

|

|

Net Profits

|

175

|

130

|

220

|

175

|

180

|

180

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Marginal costing:Â

|

Marginal Costing Statement calculator

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Unit Selling Price

|

8

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Unit Variable Cost

|

3

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Fixed Manufacturing Expenses

|

150

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Non Manufacturing Exp

|

50

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Budgeted Activity

|

75

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Period

|

04/19

|

05/19

|

06/19

|

07/19

|

08/19

|

09/19

|

|

Â

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

|

Sales

|

75

|

60

|

90

|

75

|

70

|

80

|

|

Production

|

75

|

75

|

75

|

75

|

85

|

70

|

|

Opening inventory                                                                                   Closing inventory

|

0

|

0

|

15

|

0

|

0

|

15

|

|

Â

|

0

|

15

|

0

|

0

|

15

|

5

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Period

|

04/19

|

05/19

|

06/19

|

07/19

|

08/19

|

09/19

|

|

Â

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

[£'000]

|

|

Sales

|

600

|

480

|

720

|

600

|

560

|

640

|

|

Opening inventory

|

0

|

0

|

45

|

0

|

0

|

45

|

|

Add: Variable Cost[Production]

|

225

|

225

|

225

|

225

|

255

|

210

|

|

Less: Closing Inventory

|

0

|

45

|

0

|

0

|

45

|

15

|

|

Marginal Cost of Sales

|

225

|

180

|

270

|

225

|

210

|

240

|

|

Contribution Margin

|

375

|

300

|

450

|

375

|

350

|

400

|

|

Less: Fixed Manufacturing Cost

|

150

|

150

|

150

|

150

|

150

|

150

|

|

Less:Non Manufacturing Cost

|

50

|

50

|

50

|

50

|

50

|

50

|

|

Net Profits

|

175

|

100

|

250

|

175

|

150

|

200

|

Reconciliation statements:

|

Period

|

04/19

|

05/19

|

06/19

|

07/19

|

08/19

|

09/19

|

|

Â

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

|

Sales

|

75

|

60

|

90

|

75

|

70

|

80

|

|

Production

|

75

|

75

|

75

|

75

|

75

|

75

|

|

Opening inventory

|

0

|

0

|

15

|

0

|

0

|

15

|

|

Closing inventory

|

0

|

15

|

0

|

0

|

15

|

5

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

Â

|

|

Period

|

04/19

|

05/19

|

06/19

|

07/19

|

08/19

|

09/19

|

|

Â

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

[£'000 ]

|

|

Net Profits under Absorption Costing

|

175

|

130

|

220

|

175

|

180

|

180

|

|

ADD : Fixed Overheads in opening

|

0

|

0

|

30

|

0

|

0

|

30

|

|

LESS: Fixed Overheads in closing

|

0

|

30

|

0

|

0

|

30

|

10

|

|

Net Profits under Marginal Costing

|

175

|

100

|

250

|

175

|

150

|

200

|

Problem 2a

- Calculation of followings:

(A) BEP in units and revenues-

BEP (in units)= Fixed cost / contribution per unit

= 180000/ 12

= 15000 units

BEP (in revenues)= Fixed cost/ PV ratio

= 180000/ 30*100

= £600000

Working Note:

Contribution per unit- Selling price per unit- variable cost per unit

= 40-28

= 12

PV ratio= Contribution/ sales per unit*100

= 12/40*100

= 30%

(B) Contribution margin ratio

= 12/40*100

= 30%

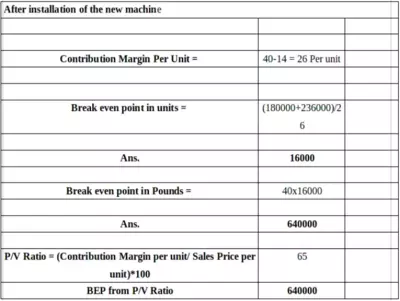

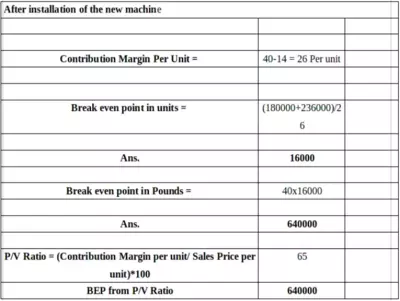

2b If machine is installed:

2c Scenario 1. Machine is not installed:

Scenario 2. If machine is installed:

Â

Â

Accounting techniques to produce financial statements.

In order to develop financial-statements in corporations, bookkeeper uses various sorts of techniques and procedures. In accordance with above function, the profit declaration is created by two costing processes, which are absorption and marginalised costs. To contrast to the above techniques, managers use other approaches to prepare reports, such as daily costing, company costing and so on (Kober, Subraamanniam and Watson, 2012).

Interpretation of produced financial statements.

In addition to the above-mentioned income reports, the sum of overall profit in each of these costing approaches will differ. As with the absorption expense process, net profit for the months-April,May,June,July,August and September is worth GBP175000, GBP220000, GBP175000, GBP180000 and GBP180000. In contrast to that, in the marginal costing cycle, net profit for the above-mentioned duration corresponds to GBP175,000, GBP100000, GBP250,000, GBP175,000, GBP150,000 and GBP200,000.

Task 3

Explanation about main advantages and disadvantages of distinct sort of planning-tools within budgetary control process:

Planning methods are particular forms and procedures by which organizations generate forecasts and predictions for the monitoring and effective accomplishment of goals. Such mechanisms offer guidelines for fiscal and non-financial priorities. Companies such as Sam Weller Ltd use this method to build a tailored/organised structure to define business uncertainty and mitigate it in order to reduce potential uncertainties. In this context here are several planning-tools which are commonly used by respective company, as follows:

Master budgeting:

Master budgeting  includes all financial budgets as well as the budgeted income statement. It is the planning tool used by the manager to direct the activities of a corporation and to judge the  performance of its various departments. This budgeting has mainly three types of parts such as operating, capital expenditures and financial budget. It helps in the coordination and communication information required at different levels. The master budgeting is basically management 's strategic plan for the further performance of the company. The benefits of master budget is to provide summary of the divisional work and helps in the achievement of goal of the organisation. It is a continuous process which is prepared every years and it is works as analytic tools for the manager. Such budgets serves as a motivation for the employees as it provides job satisfaction and contribution in the growth of the business. The disadvantage of master budget is that it is rigid in nature and difficult to update on regularly basis (Leotta, Rizza and Ruggeri, 2017).   Â

Cash Budgeting:Â

Cash budgeting is the estimation of the cash inflows and outflows over a specific period of time. It shows the cash position of the company in the future plan. In others words, it include revenue collection, expense paid and loans receipts and payments. Under such budgets manger knows the what is the position of its cash after sales is done in the organisation and all the expenses are paid off. Their are various advantages of a cash budget like companies can avoid the debt by maintaining budget for emergency purpose. It also provide to become more resourceful by eliminating all the waste from the budget. Manger stay in touch with the reality. They are able to communicate the financial position with their senior levels of management. The  disadvantages of cash budget are that it create danger for theft of available cash in the organisation. And it limits the spending power available with the manger for the projects and business purposes. Â

Flexible Budgeting:

Flexible Budgeting is a process where production changes according to the change in the activity level. This budget can be created into three levels such as basic flexible,intermediate and advanced flexible budget. Whereas basic budget is the simplest, which is prepared with different levels of production. Intermediate flexible budget measures the expenditure variation other than revenue. Under advanced budgets, expenditure vary with certain ranges of revenues. The advantages such kind of budgeting is that it helps in measuring the performance with different types of activity levels. Other benefit is  that manger give approval for other fixed and variable expenses in proportion of revenues. The disadvantages of such budget is that it is difficult to formulate with the changing levels of  performance, another disadvantage is that there is no comparison of budgeted to the actual revenues in the organisation (Novas, Alves and Sousa, 2017).

Use of planning tools in order to prepare and forecasting of budgets:

All such planning tools addressed above include different approaches to budgeting which are used by the administration to produce different kinds of forecasts and budgets. Just like Sam Weller Ltd, the strategies of the Master Budgeting system are used to estimate the total production potential of the organization based on current/existing results. Both methods facilitate business decision-making and financial data prediction practices.

Task 4

Compare ways in which organisations could use management accounting to respond to financial problems:

Due to present adverse and dynamic business environmental factors every organisation facing financial issues. Sometimes due to some internal factors company may face financial issues. These issues occurred through internal and external sources can lead to adverse situations for company. Early identification and solution of these issue is essential to achieve sustainability in business growth. Management always put their actions for identification of different issues and resolve term shortly. Different financial issues may have short-term or long term impacts on business enterprise. As Sam Weller Ltd is also facing some financial issues which affects company's performance directly or indirectly. Following are some major financial concerns as follows:

Increase in abnormal loss of inventories:Â

This key issue in company structure, being a manufacturing firm company have huge variety of inventories items and company is facing problem of increased abnormal losses like loss of stock by theft, loss of stock-in-transit etc. This issue ultimately leads to increase in overall inventories costs. Stock managers are unable to identify the key causes of these abnormal losses (Prencipe, Bar-Yosef and Dekker, 2014). Â Â Â

Increase in cost of sales:Â

Another main issue in company Sam Weller Ltd is that in manufacturing and production processes costs are increasing continuously and eventually results in increased cost of sales. This issue also affects company's gross profitability and increase in cost of each single produced unit.

In order to resolve company can utilise different techniques which are also part management accounting. These techniques enables enterprise to select appropriate measure to resolve different issues and also to trace them in quickly manner. Below is explanation about these different techniques in context of financial issues discussed earlier in Sam Weller Ltd, as follows:

Benchmarking:

This method matches the output of the products of companies with other companies that are better viewed in the market, offering quality standards. Benchmarking allows businesses to achieve the finest product requirements in market to strengthen their efficiency. Benchmarking is also a comparison point in the corporate world. Nevertheless, they use benchmarking papers as a means of contrasting them to others in sector rather than getting specific comparisons in place. Benchmarking is corporate practice which contrasts core criteria of its industry to other related businesses. Benchmarking is used by businesses to improve productivity. When company look at what other firms do, they can recognize sectors where they fail to perform. Organizations can also discover ways of improving their own processes by re-creating the design. They have modelling from many other businesses in their sector to assist in guide their improvements. Which can help company to minimise the effect of financial issues (Schaltegger, Viere and Zvezdov, 2012).

Financial Governance:

Financial management is framework of rules, procedures and procedures that direct and regulate a business. It includes adjusting the desires of different stakeholders, including shareholders, managers, clients, distributors, bankers, the government and the society. Because financial governance also offers the mechanism for achieving the goals of a business, it covers nearly every managerial area, from strategic plans and internal measures to performance assessment and corporate reporting. This techniques allow managers to quick recognisance of financial issues though strict control over suspicious business areas.

Key Performance Indicators (KPIs):Â

These are management instruments in key areas of business success to calculate and monitor progress. KPIs provide a broad overview of the company's overall well-being. Gaining knowledge from KPIs makes it possible for company to work proactively in making changes required in poor areas, thereby avoiding potentially severe losses. The KPI categorization helps the organization to calculate the performance of its activities. It phase ensures the long-term stability of business strategy and helps improve the valuation of enterprise as in terms of investment. Also these indicators points out towards existing and possible financial issues (Serena Chiucchi, 2013).

Based on above discussion on financial issues and techniques of management accounting, following is a comparison of two enterprises with respect to adoption of MA and responding to financial issues, as follows:

|

Â

|

Sam Weller Ltd

|

Whaleys Bradford Ltd

|

|

Issues and their impacts

|

As discussed earlier for company there are two challenging issues which are Increase in abnormal loss of inventories and cost of sales. Due to which company's overall profitability level has been declined.

|

Company is operating in same industry and struggling with supply chain issue and increasing operating costs. Because of these issues company's overall sales and net-operating profits are decreasing continuously.

|

|

Technique

|

Enterprise can apply KPIs to assess the effect of these issues and recognise core reason of these issues.

|

While company Whaleys Bradford Ltd can apply financial governance to assess the main factors which are affecting supply chain of company and operating profits (Siverbo, 2014).

|

|

System

|

Here Sam Weller Ltd can apply cost-accounting and inventories management system to control abnormal inventory costs and minimise cost of sales to attain targeted profits. Â

|

Whereas Whaleys can adopt cost-accounting system and job costing system in context of their financial issues. Through job costing system company can manage their supply chain effectively by assigning job roles of personnel engaged in supply chain. While though cost-accounting system company can control operating expenses to maximise operating profits. Â Â Â Â

|

Analysing how techniques of MA could aid in responding to financial problems and leading organization towards sustainable success:

The most important task in enterprise is to find an efficient solution for different financial problems / issues. Management are responsible for dealing with financial difficulties, and MA techniques and procedures are applied in nearly all businesses to this end. Since specific techniques allow a customized business process to recognise and address fiscal challenges. Therefore, they advocate structures to reduce the effect of threats on business performance. Financial issues are essential hurdles to reaching the goal of sustainable success, helping the enterprise to achieve these goals through various techniques (Teittinen, Pellinen and Järvenpää, 2013).

Evaluation of how planning tools can be applied to figure out financial problems and leading organization towards sustainable success:

The tools of planning always play a vital role in solving a company's fiscal problem. Because these methods provide huge financial components for companies that can distribute different financial capital. The volatility in financial performance can also be tracked by the company's master budgeting. Such instruments promote the considerable regulation of all business practices as a effective safeguard against potential financial problems.

Need Managerial Accounting assignment help in Australia from professional experts to score higher grades. Contact us to get the best assignment writers for your assignments.

Conclusion

This has been stated from the above report that management accounting belongs to the organizational structure. This is a wider term that includes processes, strategies, instruments and approaches that assist leadership and tactical activities of the organization. External forecasting methods such as master budgeting, cash-budgeting etc. allows companies to determine and decide accordingly their expected results. Avail online assignment help to get rid of your academic pressure.

References

- Chandar, N., Collier, D. and Miranti, P., 2012. Graph standardization and management accounting at AT&T during the 1920s. Accounting History. 17(1).  pp.35-62.

- Fiondella, C., Macchioni, R., Maffei, M. and Spanò, R., 2016, September. Successful changes in management accounting systems: A healthcare case study. In Accounting Forum (Vol. 40, No. 3, pp. 186-204). Taylor & Francis.

- Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms: Reviving contextuality in contingency theory based management accounting research. Critical Perspectives on Accounting. 45.  pp.63-80.

- Hirsch, B., Seubert, A. and Sohn, M., 2015. Visualisation of data in management accounting reports: How supplementary graphs improve everyday management judgments. Journal of Applied Accounting Research. 16(2).  pp.221-239.

You may also like to read:

Accounting And Finance

Internal Environment And Overall Capabilities Of Vodafone

Partnership Between Zoomlion And Cifa

Business Proposal

Global Marketing

Various Types of Organization

Amazing Discount

UPTO50% OFF

Subscribe now for More

Exciting Offers + Freebies

Super-fast Services

Super-fast Services

Â