4500+ Experts Writer

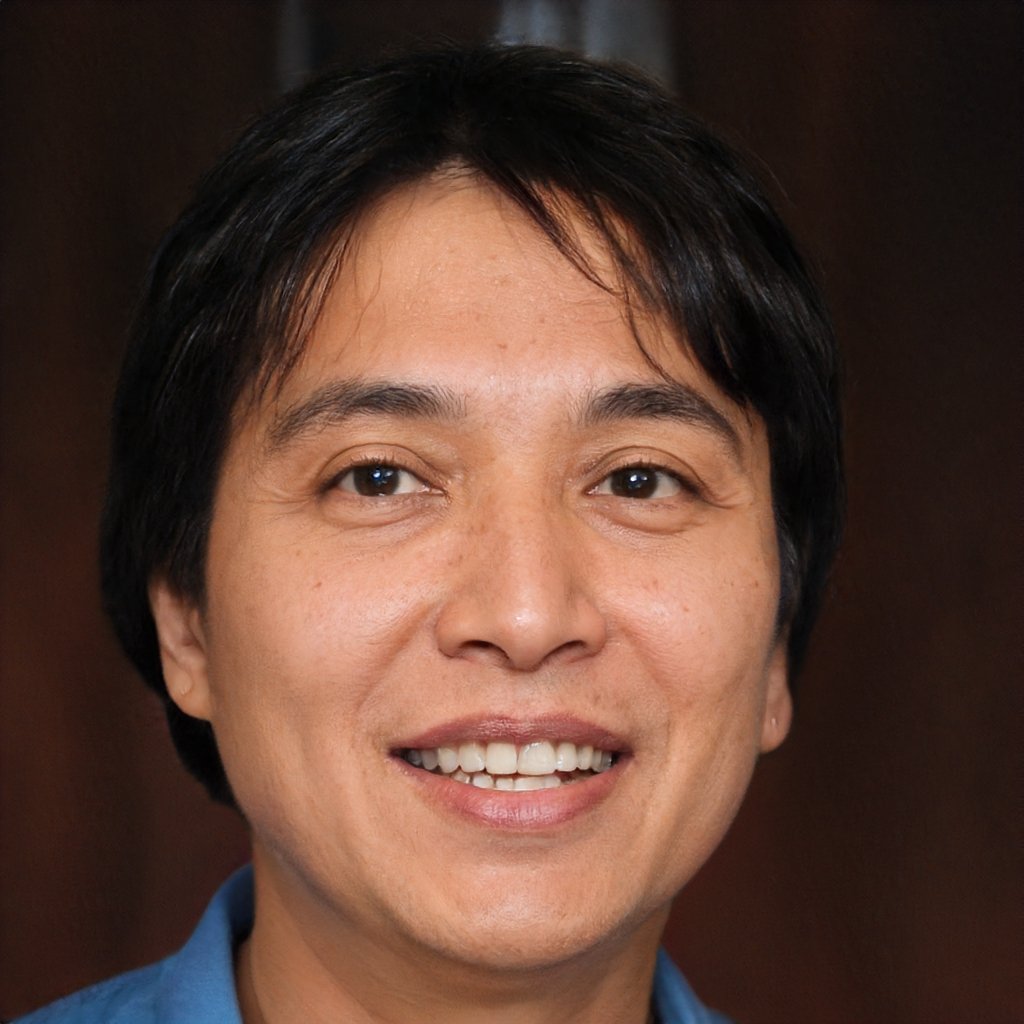

I am a master's and Ph.D. degree holder in Electrical Engineering from the University of Sydney. My knowledge has helped many college-goers in submitting effective assignments, dissertations, theses, reports, research papers, terms papers and so on. I can proficiently write in any referencing and citation style as per the guidelines of different colleges/universities. My research in Electromechanical Technology was awarded with distinction. I have written on various topics of this subject including Signal Processing, Microelectronics, Instrumentation, Telecommunications, Electromechanical Technology, Thermal and Hydraulics Prime Movers, Analog Electronic Circuits, Network Analysis and Synthesis, Electrical Engineering Materials and many more. I enjoy teaching and swimming in my spare time.

Joseph Stuart

Orders in Progress - 56

Orders Finished - 2735

After completing my post-graduation, I worked as a research consultant at an NGO for two years. It is due to the practical knowledge I gained there that I am able to deal with assignment questions on any topic related to this subject. During my tenure as an academic writer, I have explored and covered many disciplines of this subject in order to bring out unique ideas for the assignments. The documents delivered from my end not just help students score well but also serve as a quality reference material for the topic.

Xavier Scott

Orders in Progress - 12

Orders Finished - 1321

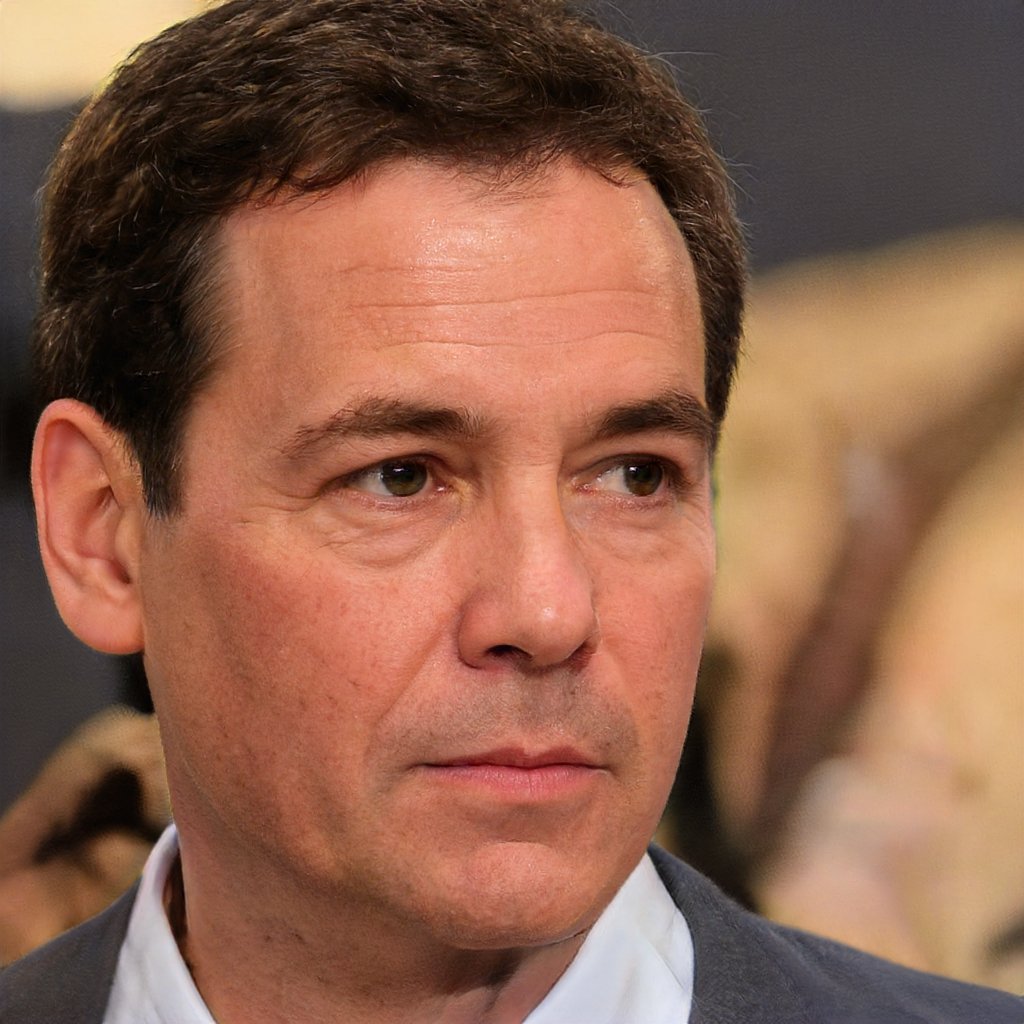

After completing my Ph.D., I worked as a Digital electronics engineer for two years. Then, I joined Global Assignment Help Australia as an academic writer. Here I learned all the intricacies of academic paper writing. With my knowledge and excellent writing skills, I started offering assignment writing assistance to the university students and have successfully delivered more than 2500+ projects in the last six years. I hold expertise in all the disciplines that come under this subject, such as Combinational vs. Sequential, Structure of digital systems, Asynchronous systems, Synchronous systems, Computer design, Register transfer systems, Computer architecture, Automated design tools, Design issues in digital circuits, etc.

Eric Branchett

Orders in Progress - 14

Orders Finished - 2672

I am a certified academic writer in Strategy Management and is working with Global Assignment Help Australia to provide academic writing assistance to the students. I have been successful in delivering numerous high-quality research papers, assignments, reports and term papers to the college students on various topics like Globalization and the virtual firm, Internet and information availability, Strategy as adapting to change and as operational excellence, Quality Re-engineering, Perspectives on strategy, Strategy as problem solving, Creative vs analytic approaches, Non-strategic management, and many more. Also, my professional experience helps me to keep myself updated of the new researches in this field. The students can approach me for taking writing assistance on any topic related to this area.

Daniella Jospeh

Orders in Progress - 46

Orders Finished - 2411

Amazing Features We Offer

24*7 Help Service

100% Satisfaction

No Privacy Infringement

Super-fast Services

Subject Experts

Professional Documents