United Finance Company is finance company which is based in Oman and successfully executing its business there. The organisation was founded in year 1997 and it is listed on Muscat Securities Market. It is offering different types of financial products such as bancassurance, corporate deposits and conventional finance to the corporate business entities. The business is executed through retail segments (Guilding, Lamminmaki and McManus, 2014). Other products that are provided by United Finance Company are bridge loans, hire purchase, bill discounting, debt factoring, car loan, vehicle finance etc. Currently this finance company is dealing with an issue of staff turnover which is affecting its performance and profitability. The organisation operates business in 8 different locations. Main aim of this assignment is to find appropriate solution for the problem of staff turnover of United finance Company . In this project report detailed analysis of the problem with its statement, identification of analytical tools, justification about the usage of the tools are discussed.

Organization's Background And Industry Context

Organisation's background

United Finance Company   is based in Oman and operating its business in 8 locations including Ibra, Sohar, Nizwa, Barka, Ibri, Mawelah etc. It is rendering different types of services to the corporate organisations. The services are composite loans, corporate deposits, financing of receivables and leasing, equipment and commercial vehicle finance, hire purchase etc. The organisation was founded in year 1997. It was established by 20 different promoters who also contributed in the issued capital of the business. Their share in the whole capital of the organisation was 60% (Overview of United Finance Company  , 2018).

United Finance company is one of the leading financial companies in Muscat. Business of the organisation was started with an amount of 5 million Omani Rial (United Finance company  , 2018). Vision, Mission and objectives of the company are mentioned as follows:

Vision:Â

United finance company has a long term vision to become the first choice of the clients and best finance company for the stakeholders so that business can be operated with higher profitability in upcoming period.

Mission:

To create growth for the organisation by offering customised financial solutions to the clients, partnering with the enterprise's subordinates for mutual growth and becoming an impressive corporate business entity.

You Share Your Assignment Ideas

We write it for you!

Most Affordable Assignment Service

Any Subject, Any Format, Any Deadline

Order Now View Samples

Objectives:Â

The organisation is willing to capture large market share by rendering good services to all the clients. Another objective of United Finance Company   is to increase its profits by 10% in upcoming two years by enhancing quality of the services (Daouk-Öyry and et.al ., 2014).

More Suggested:Â

Industry context

United Finance Company is operating in Financial sector of Oman. This sector is continuously growing and contributing a higher percentage in the economy of nation. The government of Oman does not interfere in the financial market and there is no restriction or limitation of the flow of capital and repatriation of profits. Opportunities in finance sector of Oman are increasing rapidly and it helps the companies to increase profits. Legal parties of the country support this industry as it assists in the development of the economy. According to a research this sector has contributed 1.63% in the GDP (gross domestic product) of Oman (Anvari, JianFu and Chermahini, 2014). A SAOG company in Oman is considered as   when it is a joint stock company, but the minimum capital required for this type of company is 2 million.

Problem Statement

“United Finance company is facing a problem of unstable staff turnover which is taking place as the employees are leaving their jobs for some other opportunitiesâ€. For all the concerned persons of the business entity need to make effective decisions and appropriate strategies so that this problem can be resolved successfully (Jeon and et.al., 2015). The existing workforce is leaving the company for different reasons. All the below described points are defined to elaborate the statement:

Looking for better opportunity:Â

Most of the employees of United Finance Company   are leaving their jobs because they are looking for better career options. Managers of the organisation needs to retain them by providing the opportunities so that they can grow. If there is no options for growth than it will become more complex to retain skilled and experienced employees. If workforce of the company do not find any development opportunity then they prefer to switch as they want to enhance their career.

In stable financial condition:

When an organisation is financially unstable then the employees wish to join such company which is financially strong and able to provide them a higher pay. Unstable staff turnover of United Finance Company has resulted because of its unstable funds and position. Staff members thinks that their future is not safe in the organisation and they start to look for other career opportunities where they can have a secure future (Griffin, Hogan and Lambert, 2014).

Lack of employer's support:Â

When managers and employees are having conflicts and there is no support of them to the workers than it results in unstable staff turnover. It is not possible for the staff members to work in an organisation when there is no top authority support to them. In United Finance Company the workers are leaving jobs as they do not have top management support (M. Abu Elanain, 2014).

Extra working hours:Â

Employers in United Finance Company are forcing the employees to work for extra hours. It decreased their interest in the organisation and they prefer to change their jobs. The worker wants to work in such enterprises where they can work freely with no restrictions. In United Finance Company   there are various restrictions on staff members and it has resulted in unstable staff turnover.

No monetary benefits:Â

Employees in United Finance Company   are not getting any monetary benefits except their salary. There is no bonus and incentive scheme so that employees can be motivated. It resulted in lack of work force involvement and engagement in the job and increased staff turnover (Kovner and et.al., 2014).

All the above described reason has resulted in unstable staff turnover of United Finance Company. The managers and other concerned persons of the organisation are suggested to decrease it and try to retain the employees so that losses can be minimised. It is very important for the employers of United Finance Company   to identify the causes of the problem and then take appropriate action so that all the problems can be resolved. It can help to operate business successfully with higher profits. If the issues are not resolved than it is not possible to perform all the operational and executional activities effectively (Garner and Hunter, 2014).

Identification Of Analytical Tools

The problem that United Finance Company   is currently facing is unstable staff turnover. For all the concerned persons of the organisation it is very important to resolve the problem so the business can be executed appropriately (Techniques to resolve business problems, 2018). Following methods can be used to identify the solution for the problem:

Mind mapping

This technique is used by the organisations in order to find appropriate information of a central word. It can guide to analyse the factors that are causing problems for the organisation. When all the causes of the issues are identified than it helps to find effective solution for that problem. As United Finance Company   is dealing with the difficulty of unstable staff turnover than the managers of the business entity can use this technique to find solution for the trouble (Bointner, 2014).

The five whys

It is an interactive and interrogative technique which is used to analyse the relationship between the cause and effect of a problem. This method can be used by the top executives of United Finance Company   in order to analyse the real cause of problem and then find appropriate solution for the same.

Fish bone analysis

This is a method which is used to identify the central cause of a difficulty. Managers of United Finance Company   can use this technique while looking for marketing the solution for the problem of unstable employee turnover (Duffield and et.al., 2014).

Soft system methodology:

It is a technique that helps to find appropriate solutions for the problem of companies. This technique is very beneficial for United Finance company as it can guide to analyse the ways in which problem of unstable staff turnover can be resolved.

Hard system methodology:

This technique can be defined as a tool that helps to analyse the system which is creating the problem so that it can be resolved quickly. It is very beneficial for United Finance Company as it will direct the managers to reach the actual cause of problem of unstable staff turnover.

All the above mentioned techniques can be used to find effective solution for the problem of unstable staff turnover. From all the methods the best suited method is mind mapping method which should be used by the top executive of United Finance Company  . By using this method actual reason for the problem can be identified that can help to find best solution for the problem. The causes that are figured out by this technique are as follows:

- In United Finance Company there is lack of growth opportunities for the employees (Takawira, Coetzee and Schreuder, 2014).

- Another cause of the problem is lack of monetary benefits and extra working hours that resulted in employee turnover.

According to above mentioned causes the solutions that are identified by the managers are as follows:

- Providing monetary benefits to the employees:As United Finance Company   is facing problem of staff turnover due to lack of monetary benefits and extra working hours. The mangers can resolve the issue by offering good benefits to the employees according to their performance. It will result in enhanced productivity and increased profitability because if new schemes for bonus and incentive is announced then employees will work hard to attain higher benefits. It will also increase employee retention rate which is the best solution for the problem of unstable staff turnover (Singh and et.al., 2015).

- Creating growth opportunities for the staff members:As another reason for unstable staff turnover of United Finance Company   is lack of growth opportunities hence, the managers should create such chances for them in order to resolve their issues. It can be generated with the help of giving promotion to the staff according to their capability. This is a good solution for the problem of unstable workforce turnover (Oruche and et.al., 2014).

Both the above described solutions are going to be implemented by the managers of United Finance Company   in order to resolve the issue of unstable staff turnover. Both of them can help to deal with the problem appropriately. If company provide growth opportunities and monetary benefits like bonus and incentives to the staff members than it will result in increased employee retention and engagement rate. It may help to retain old and skilled workers so that business can be operated in impressive manner (Glisson, 2015).

Brief Description And Justification Of Usage

As Mind mapping technique is used by the managers of United Finance Company   in order to find solution for the problem of unstable staff turnover. This method is used because it is the most suitable for the organisation according to its situation (Browne, 2016). It is a technique which helps to figure out the causes of the problem which is affecting overall performance of the company. Appropriate uses of the techniques are as follows:

- Identifying new ideas:Mind Mapping technique is mainly used to identify new and innovative ideas so that alternatives can be determined in order to resolve organisational problems. As Mind mapping technique is used by United Finance Company   for finding new ways in which the problem can be resolved. It is very important for the managers to use the technique effectively as it can guide to resolve the issue of unstable staff turnover.

- Appropriate decision making:Mind mapping technique is used to make appropriate decisions that can help to overcome all the issues that are faced by the business entities. As United Finance Company   is facing an issue of unstable staff turnover this problem can be resolved by making good decisions. Managers of the organisation should take the problem seriously and then pass their judgement on the situation (Margerum and Robinson, 2015).

- Formulate effective strategies:Mind mapping technique guides to figure out the causes of problems that are faced by an organisation so that effective strategies can be formulated to resolve all of them. This technique is also used by the management of United Finance Company   in order to figure out the cause of problem and then make strategies to resolve the problem of staff turnover (Harding and et.al., 2017).

- Analysing future opportunities:Main use of mind mapping technique is to analyse future opportunities for the organisation in which the business can be developed and growth can be achieved. This technique is also used by the managers and employers of  United Finance Company   so that they can retain their employees and enhance their engagement in the work. They have analysed that organisation can grow in future if employees are retained. The solutions are also formulated according to the analysis in which management have decided to provide monetary benefits to all the employees (Zhu and et.al., 2017).

- Forming solutions according to the problem:Mind mapping technique is used to form solutions for the problems according to their requirements. It is also utilised by managers of  United Finance Company   in order to find appropriate solution for the problem of unstable staff turnover.

Mind mapping is used for all the above described purposes and it guides the managers and other concerned persons of the organisations to find appropriate solutions for the business issues.

Justification:

Mind mapping technique is used for the purpose of finding solution for the problem of unstable staff turnover because it can help to find the actual causes of the difficulty. The reasons are used to find solution for the business issues so that all of them can be resolved and won’t take place again (Pichot and Coulter, 2014). Following perspectives can elaborate the justification:

Business strategy:Â

Mind mapping technique is used by United finance company because it helps to find best ways that may guide to formulate appropriate business stratgies in order to resolve the issues.

Operation and project management:Â

Mind mapping help to manage all the operations and projects of United finance company as it is a method of finding the issue which is affecting performance of organisation. When the problems are identified than solutions are implemented and in this situation projects and operations can be managed appropriately.

Financial:Â

Mind mapping is used to resolve the problem of staff turnover which is resulting in decreased profits of United Finance company. As it can help to find solution for the issues and it will also result in the solution of financial problems.

Analysis Of The Problem

United Finance Company   is currently dealing with the problem of unstable staff turnover which affecting organisation's performance, market image, profitability and productivity. It is very important for the management of the company to find appropriate solutions for the issues so that business can be operated in an appropriate manner. All the impacts of the problem are described below:

- Decreased productivity:The problem of unstable staff turnover continuously decreasing productivity of the organisation because employees are leaving the company. If there are no sufficient staff members in the organisation than it is not possible to successfully and productivity perform operational activities. The problem is affecting performance of the business entity because of unstable staff turnover (Asegid, Belachew and Yimam, 2014).

- Reduction in employee retention rate:The problem of unstable employee turnover is taking place due to lack on monetary benefits and growth opportunities. The issue is resulted in reduced staff turnover which is creating problem for the organisation. If the company is not having skilled and experienced workers than it is not possible to execute the business appropriately (Cosgrave, Hussain and Maple, 2015).

- Reduced profits and revenues:Profits and revenues of United Finance Company   are decreasing because of insufficient number of skilled and experienced employees within the organisation. The problem is affecting market image and also decreasing interest of stakeholders. It will reduce investments and equities of the organisation and the operational capacity of business will also get affected. If United Finance Company   is not having appropriate employees who are required to conduct all the operational activities successfully than it is not possible to generate profits. When there are no profits than business cannot be executed smoothly.

All the above described points are the impacts of the issue of unstable staff turnover. This problem is affecting the performance of  United Finance Company   and also decreasing its profits and revenues. It is very important for the business entity to find appropriate solutions for the problems and then implement all of them (Lartey, Cummings and Profettoâ€ÂÂMcGrath, 2014). Â

Conclusion

From the above project report it has been concluded that staff turnover is the problem that can be faced by most of the organisations as it is related to employees and organisation's strategies. If the company is not providing any type of monetary benefits, management is not supporting to the staff, no growth opportunities etc. to the employees than they may switch to other business entities. If the enterprise if willing to retain the staff members than it is very important to provide them appropriate benefits according to their performance. The problem of staff turnover results in decreased profits, revenues, employee retention rate etc.

Realistic Recommendations

As United Finance Company is facing an issue of unstable staff turnover which affecting overall performance of the organisation. Following recommendations are provided to the business entity in order to resolve the problem:

- Implement new bonus and incentives scheme so that employees can be retained.

- Create new growth opportunities for existing staff members in order to motivate them to work hard.

- Formulate new strategies so that issue of unstable staff turnover can be resolve.

Action Plan

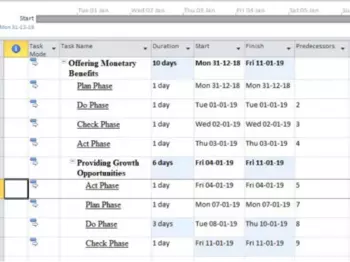

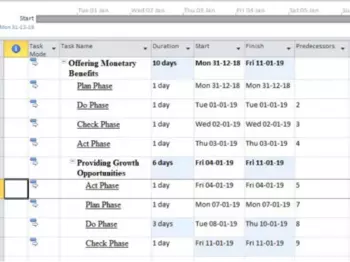

An action plan for implementing both the solutions are as follows:

Offering Monetary Benefits:Â

For this, PDCA cycle can be used to provides better monetary benefits  which are as follows:

- Plan Phase:In this phase, United finance company   should analysis the current monetary benefits and in which condition these are payable. Accordingly, derive a plan to enhance the monetary benefits as well as find the source for such extra cost. As a result,   can easily handle it in optimum way.

- Do Phase:In this phase, organisation need to the work that are planned in earlier phase.

- Check Phase:After doing above two phases, organisation need to check “what they expectedâ€Â and “what they receive actuallyâ€.

- Act Phase:At last, organisation need to do corrective action for the deviation between planned work and actual work done.

Providing Growth Opportunities:Â Â

United finance company should provides growth opportunities through implementing PDCA cycle which are as follows:

- Plan Phase:In this phase, organisation should evaluate the current situation of staff and accordingly make a plan to provide growth opportunities such as rotation of positions after a targeted period, provides training to staff. These can help the staff to gain more knowledge, so that they can take advantages of growth opportunities. Â

- Do Phase:In this phase, organisation need to the work that are planned in earlier phase.

- Check Phase:In this phase, organisation need to check the actual performance.

- Act Phase:In this, organisation need to do corrective action.

A Gantt chart for the action plan is as follows:

References:

- Anvari, R., JianFu, Z. and Chermahini, S. H., 2014. Effective strategy for solving voluntary turnover problem among employees. Procedia-Social and Behavioral Sciences. 129. pp.186-190.

- Asegid, A., Belachew, T. and Yimam, E., 2014. Factors influencing job satisfaction and anticipated turnover among nurses in Sidama zone public health facilities, South Ethiopia. Nursing research and practice, 2014.

- Bointner, R., 2014. Innovation in the energy sector: Lessons learnt from R&D expenditures and patents in selected IEA countries. Energy Policy. 73. pp.733-747.

- Browne, D. ed., 2016. Adaptive user interfaces. Elsevier.

- Cosgrave, C., Hussain, R. and Maple, M., 2015. Factors impacting on retention amongst community mental health clinicians working in rural Australia: a literature review. Advances in Mental Health. 13(1). pp.58-71.

- Daouk-Öyry, L. and et.al., 2014. The JOINT model of nurse absenteeism and turnover: a systematic review. International journal of nursing studies. 51(1). pp.93-110.

- Duffield, C. M. and et.al., 2014. A comparative review of nurse turnover rates and costs across countries. Journal of Advanced Nursing. 70(12). pp.2703-2712.

- Garner, B. R. and Hunter, B. D., 2014. Predictors of staff turnover and turnover intentions within addiction treatment settings: Change over time matters. Substance abuse: research and treatment. 8. pp.SART-S17133.

- Glisson, C., 2015. The role of organizational culture and climate in innovation and effectiveness. Human Service Organizations: Management, Leadership & Governance. 39(4). pp.245-250.

- Griffin, M. L., Hogan, N. L. and Lambert, E. G., 2014. Career stage theory and turnover intent among correctional officers. Criminal Justice and Behavior. 41(1). pp.4-19.

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies