Management accounting is the process of controlling, managing, analysing, assessing and evaluating reports that are generated by the managers of the companies. All of them are presented in front of internal stakeholders such as managers, directors, equity shareholders in order to analyse the organisation's performance its position in the market (Hiebl, 2014). It helps the managers to make strategic decisions so that all the predetermined goals like profits maximisation and customer satisfaction can be successfully achieved. For all business entities it is very important to conduct management accounting every year so that the actual status of the company can be examined. The company which is chosen for this report is UKC Furnitures. Various aspects are discovered under this report such as the application of range of different management accountant techniques and uses of planning tools. A comparison of the way in which a company can use management accounting to respond to financial problems have also been covered under this assignment.

TASK 1

1.1 Calculation of cost by using various management accounting techniques

Cost: It can be defined as the total expenses that have been faced by an organisation while manufacturing a product. There are various types of cost that may take place in the production process. These are fixed, variable and semi variable. The expenses that does not change with the production are considered as fixed. All the costs that are varies with the manufacturing units are the part of variable costs. All the expenses that are partially fixed and partially variable are called semi variable. As UCK Furnitures is a manufacturing company hence all these costs are faced by the company in the production process. It is very important for the managers of the company to set appropriate prices for all the items that are sold by the organisation so that large number of customers can be attracted. It will help to expand the business in different locations (Arroyo, 2012). There are two main types of costing techniques that can be adopted by the company in order to determine profits. Both of them are described below with the cost card:

Marginal costing: It is technique which is used by the companies to calculate the marginal cost that depicts that organisation is achieving economy of scale or not. In UCK Furnitures this method is used by the managers to evaluate the level where the organisation can attain profits. It helps to analyse the impact of variable costs on the output units of the company. Cost card for this method for two months is as follows

|

Â

|

January

|

|

Particulars

|

Â

|

Amount

|

|

Total sales (35*9000)

|

Â

|

315000

|

|

Variable costs:

|

Â

|

Â

|

|

Opening inventory

|

Nil

|

Â

|

|

Direct material (12*11000)

|

132000

|

Â

|

|

Direct labour (8*11000)

|

88000

|

Â

|

|

Variable overheads (5*11000)

|

55000

|

Â

|

|

Closing inventory (25*2000)

|

-50000

|

-225000

|

|

Variable selling cost

|

-9000

|

-9000

|

|

Gross profit

|

Â

|

81000

|

|

Fixed costs:

|

Â

|

Â

|

|

Fixed production cost

|

2000

|

Â

|

|

Fixed selling cost

|

20000

|

-22000

|

|

Net profit

|

Â

|

59000

|

|

Â

|

February

|

|

Particulars'

|

Â

|

Amount

|

|

Total sales (35*11500)

|

Â

|

402500

|

|

Variable costs:

|

Â

|

Â

|

|

Opening inventory (25*2000)

|

50000

|

Â

|

|

Direct material (12*9500)

|

114000

|

Â

|

|

Direct labour (8*9500)

|

76000

|

Â

|

|

Variable overheads (5*9500)

|

47500

|

Â

|

|

Closing inventory

|

Nil

|

Â

|

|

Variable selling cost

|

-11500

|

-287500

|

|

Gross profit

|

Â

|

103500

|

|

Fixed costs:

|

Â

|

Â

|

|

Fixed production cost

|

2000

|

Â

|

|

Fixed selling cost

|

20000

|

-22000

|

|

Net profit

|

Â

|

81500

|

Absorption costing:Â This method is used to analyse the absorption cost. According to this method all the expenses that are involved in the production process are going to be absorbed from the sales. In UCK Furnitures this technique is used to analyse that organisation is able to recover all its direct and indirect expenses from all the revenues (Merchant, 2012). Cost card of absorption costing for January and February are as follows:

|

Â

|

January

|

|

Particular

|

Â

|

Amount

|

|

Sales (35*9000)

|

Â

|

315000

|

|

Production cost

|

Â

|

Â

|

|

Opening inventory

|

Nil

|

Â

|

|

Direct material (12*11000)

|

132000

|

Â

|

|

Direct labour (8*11000)

|

88000

|

Â

|

|

Variable overheads (5*11000)

|

55000

|

Â

|

|

Overheads absorbed (2*11000)

|

22000

|

Â

|

|

Closing inventory (27*2000)

|

-54000

|

Â

|

|

Over/ under charged

|

-2000

|

-241000

|

|

Gross profit

|

Â

|

74000

|

|

Non production costs:

|

Â

|

Â

|

|

variable selling costs

|

9000

|

Â

|

|

Fixed selling cost

|

2000

|

-11000

|

|

Net profit

|

Â

|

63000

|

Â

|

Â

|

February

|

|

Particular

|

Â

|

Amount

|

|

Sales (35*11500)

|

Â

|

402500

|

|

Production cost

|

Â

|

Â

|

|

Opening inventory (27*2000)

|

54000

|

Â

|

|

Direct material (12*9500)

|

114000

|

Â

|

|

Direct labour (8*9500)

|

76000

|

Â

|

|

Variable overheads (5*9500)

|

47500

|

Â

|

|

Overheads absorbed (2*9500)

|

19000

|

-310500

|

|

Over/ under charged

|

-1000

|

-1000

|

|

Closing inventory Â

|

Nil

|

Â

|

|

Gross profit

|

Â

|

91000

|

|

Non production costs:

|

Â

|

Â

|

|

variable selling costs

|

11500

|

Â

|

|

Fixed selling cost

|

2000

|

-13500

|

|

Net profit

|

Â

|

77500

|

1.2 Different management accounting techniques

There are various management accounting techniques that can be used by managers of UCK Furnitures in order to enhance its performance. All of them are described below:

Standard costing: It is a traditional technique which is used to compare actual and budgeted figures of a company. In UCK Furnitures this method is used by the managers to determine the difference between actual and standard performance in order to make strategic decisions. It helps to control all the costs and also help to make strategies so that production expenses can be reduced  (Cooper, Ezzamel and Qu, 2017).

Historical costing: This method guide organisations to record all the assets and liabilities in the financial reports on historic prices so that actual status of the company can be determined by stakeholders. In UCK Furnitures this method is used to identify the difference between replacement and original cost of assets.

1.3 Interpretation of the cost cards of marginal and absorption costing techniques

Two different types of techniques are used to calculate net profits of UCK Furnitures. While calculating net income from marginal costing it has resulted in 81000 gross profits for January and 103500 for the month of February. In absorption costing gross profits for January and February are 74000 and 91000 respectively. Net profits by marginal costing are 59000 and 81500 fro both the months and by absorption costing net profits are 63000 and 77500 for January and February. It has been suggested to the company to use marginal costing as it shows higher gross profits as compare to another method.

Looking for Free Tools to Ease Your Academic Writing Stress? CLICK HERE!

TASK 2

2.1 Advantages and disadvantages of planning tools that are used in budgetary control

Budget: It can be defined as a financial plan which is made by the organisations in order to reduce over spendings. In UCK Furnitures budgets are formulated by the managers in order to successfully operate the business. If the organisation is planning to execute business in appropriate manner than it is very important to control the budgets. Budgetary control can be explained as the procedure of setting financial goals that are going to be achieved in upcoming period  (DRURY,   2013). Different types of planning tools are used by the management of the business entity in order to achieve all the objectives. All of them are discussed below:

Contingency Tools: Such type of tools help the companies to analyse possible contingencies that may take place in future and affect overall performance of the organisation. In UCK Furnitures such type of tool is used to deal with all the problems that may result negatively. The problems are reduction in the demand of products and reduced profits.

|

Advantages

|

Disadvantages

|

|

It guides the managers to take appropriate action in difficult conditions.

|

Technical knowledge is required to implement such type of tools it is not possible to use them without proper knowledge.

|

|

All the unfavourable situations like reduction in profits can be determined with the help of contingency tools.

|

It takes a lot of time to implement this tool.

|

Forecasting Tools: The possible outcomes of operations can be estimated with the help this tool. It can forecast positive as well as negative impact of the actions that are taken by managers and other members of the company. In UCK Furnitures forecasting tools are used to determine the situations that are going to be faced by the organisation in future  (Chan, Wang and Raffoni, 2014).

|

Advantages

|

Disadvantages

|

|

It can help the managers to be prepare to face possible future consequences.

|

It is not possible to forecast conditions appropriately.

|

|

It is very beneficial to plan in advance for future situations.

|

Cost involved in the application of such tools and it is not possible for all the companies to bear high cost.

|

2.2 Estimation of expenses by using high low method

For the estimation of the expenses for different working hours high low method is used and the calculations for this are as follows:

Step 1:Â Identification of the highest and lowest activities

Higher activity level= 795 hours in June

Lower activity level= 505 hours in February

Step 2: Calculation of variable cost per hour

variable cost per hour= Difference between cost component of highest and lowest activity level/ difference between higher and lowest activity level

= (9820-7410)/ (795-505) = 8.31 per hour

Step 3: Â Calculations of fixed cost

Fixed cost= Higher activity cost- (variable cost per unit* highest activity units)

or Lowest activity cost- (variable cost per unit* lowest activity units)

= 9820-(8.31*795) = 3213.55

Step 4:Â Calculation of total variable cost

Total variable cost= variable cost per hour* number of required hour

For 650 hours= 8.31*650

=5401.5

For 750 Hours= 8.31*750 = 6232.5

Step 5: Calculation of total cost for July and August

Total cost= Fixed cost+ variable cost

For 650 hours= 3213.55+5401.5

= 8615

For 750 hours= 3213.55+6232.5

= 9446

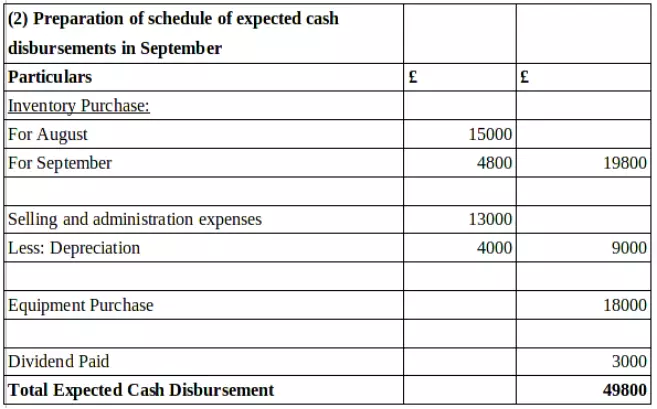

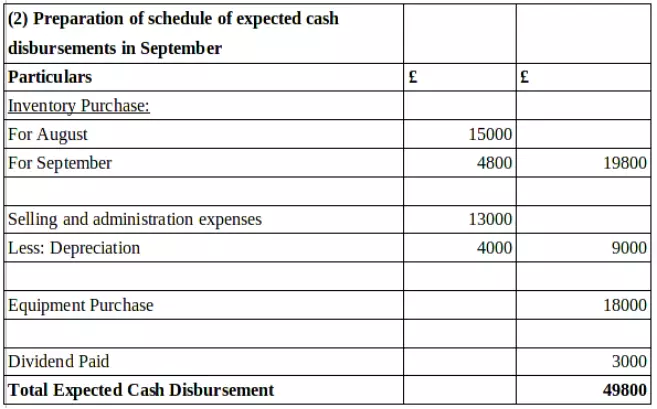

2.3 Purpose of budget and preparation of cash budget

Purpose of budget:

- Budgets are generated to smoothly run the operations because if all the departments are having sufficient funds then business can be executed successfully.

- Another purpose of budget is to forecast future incomes and expenses in order to make strategic decision  (Nitzl, 2016).

Preparation of cash budget:

TASK 3

3.1 The ways in which organisations are adapting management accounting system

Calculation of Ratios:

|

UCK Furnitures

|

UCK Woodworks

|

|

ROCE of the company is 17.24% which means that organisation is getting higher returns on the investments.

|

ROCE of the organisation is 8.6% that depicts that it is receiving less returns on the investments as compare to UCK Furnitures.

|

|

Asset turnover ratio of the company is 0.68 time which shows that organisation's efficiency is high    (Bennett, Schaltegger and Zvezdov, 2013).

|

Asset turnover ratio of the company is low as compare to UCK Furnitures which means that overall efficient of the company is not good.

|

|

Operating profits margin of this organisation is 25.03% which depicts that the company is having good operating profit margin.

|

It margin is low as compare to other company hence the managers should make appropriate decisions to enhance profits.

|

3.2 Management accounting help to improve the financial performance of both the companies

From the above comparison it has been identified that UCK Woodworks is facing different types of financial problems such as low operating profit margin and asset turnover. Following techniques can be used by the managers in order to overcome all the issues:

KPI:Â

Key performance indicators are mainly used to evaluate performance business entities so that profits can be maximised. In UCK Woodworks it is used to resolve the problem of reduced profit margins as it can help the managers to measure success and failure of the actions. When they have idea of success or failure than they can plan in advance to overcome all the problems like profit reduction   (Melnyk and et.al., 2014).

Financial governance:Â

This technique guide the organisations to apply all the accounting rules and regulations so that business can be operated appropriately. In UCK Woodworks this method is used to overcome challenge of low asset turnover because it can guide the managers to appropriately use all the assets  (Gunarathne and Lee, 2015).

3.3 Evaluation of planning tools to resolve financial problems

In UCK Furnitures two different types of planning tools are used to overcome all the financial problems because they can help to estimate them in advance. There are various different methods that can also be used to resolve financial problems that may take place in future or currently faced by the organisation. These are variance analysis, ratio analysis, budgetary control etc. All these methods guide the managers to evaluate organisation's performance and problems and than make policies so that all of them can be dealt appropriately  (Dekker,  2016).

Need accounting assignment help in Australia from professional experts to score higher grades. Contact us to get the best assignment writers for your assignments.

Conclusion

From the above project report, it has been concluded that there are various types of management accounting techniques such as marginal and absorption costing that can be used by the companies to calculate their profits. In budgetary control different types of planning tools like contingency and forecasting are used by the companies that may help to forecast favourable and adverse situations that may take place in future. All these tools and techniques such as KPI, Financial governance, variance analysis may help to overcome all the financial problems.

References

- Arroyo, P., 2012. Management accounting change and sustainability: an institutional approach. Journal of Accounting & Organizational Change. 8(3). pp.286-309.

- Bennett, M. D., Schaltegger, S. and Zvezdov, D., 2013. Exploring corporate practices in management accounting for sustainability (pp. 1-56). London: ICAEW.

- Chan, H. K., Wang, X. and Raffoni, A., 2014. An integrated approach for green design: life-cycle, fuzzy AHP and environmental management accounting. The British Accounting Review. 46(4). pp.344-360.

- Cooper, D. J., Ezzamel, M. and Qu, S .Q., 2017. Popularizing a management accounting idea: The case of the balanced scorecard. Contemporary Accounting Research. 34(2). pp.991-1025.

- Dekker, H. C., 2016. On the boundaries between intrafirm and interfirm management accounting research. Management Accounting Research. 31. pp.86-99.

- DRURY, C. M., 2013. Management and cost accounting. Springer.

- Gunarathne, N. and Lee, K. H., 2015. Environmental Management Accounting (EMA) for environmental management and organizational change: An eco-control approach. Journal of Accounting & Organizational Change. 11(3). pp.362-383.

You may also like to read: Management Accounting

Amazing Discount

UPTO55% OFF

Subscribe now for More

Exciting Offers + Freebies